Since FHA only insures the loan versus long run borrowers’ default and doesn’t originate the loan on their own, they cannot pressure a home loan lender to extend an FHA loan to borrowers that drop below their set criteria. This is what’s generally known as an “overlay” by lenders.

The applicant’s credit score score is a remarkably sizeable determinant in acquiring an FHA loan. In Texas, persons have to have a minimal FICO® rating of 580 being suitable to the favorable alternative of a modest down payment of three.

With its low deposit rate and more peaceful qualification requirements, the FHA loan offers itself as an extremely attractive choice to a lot of aspiring homeowners in Texas.

The house need to move the inspection and appraisal done by an FHA-permitted appraiser. This is the important evaluate in order that the house fulfills the safety and structural suggestions established through the HUD.

Even so, the actual interest charge you’ll receive on an FHA loan could vary depending on several aspects, which include your credit rating, loan amount, and The existing marketplace situations. It’s constantly a smart idea to compare charges from many lenders to make sure you’re getting the finest offer possible in your predicament.

We do not ask buyers to surrender or transfer title. We do not check with end users to bypass their lender. We motivate people to Get in touch with their lawyers, credit score counselors, lenders, and housing counselors.

We evaluate and interview the two exterior and internal reputable resources for our fha loan texas requirements content material and disclose sourcing inside our content.

5% – 10%. This also relates to you should you’ve Earlier declared individual bankruptcy or have experienced other economical concerns. You see, FHA loans have your again, somewhat like the safety of the conforming loan.

Like most other loans, FHA loans need down payments in case you default. But the down payment is just not just about as higher as other loan sorts commonly demand.

A preapproval relies on an assessment of earnings and asset information you supply, your credit score report and an automatic underwriting program overview. The issuance of the preapproval letter isn't a loan motivation or possibly a guarantee for loan approval. We may provide a loan commitment Once you submit an application and we accomplish a closing underwriting evaluation, such as verification of any data supplied, assets valuation and, if relevant, Trader acceptance, which can cause a alter to your conditions within your preapproval.

Some packages may perhaps involve partial repayment of the DPA guidance In the event the home is bought inside nine decades

FHA loans are actually building homeownership much more obtainable for decades. Tailored to borrowers with lower credit history, the FHA causes it to be attainable to get a household that has a credit history score of just 580 and only three.

buy the FHA coverage that shields your mortgage lender. This is known as “home loan insurance policies top quality” or MIP for your life of the loan or till the FHA home loan is refinanced into A different form of mortgage loan. We go above this intimately down below.

We use Key sources to assistance our operate. Bankrate’s authors, reporters and editors are subject-make any difference industry experts who carefully reality-Examine editorial material to ensure the information you’re looking through is exact, timely and relevant.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Robert Downey Jr. Then & Now!

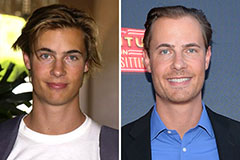

Robert Downey Jr. Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!